US Treasury Bonds: Risks and Rewards in Today’s Economy

Anúncios

Investing in US Treasury Bonds with a 10-year maturity involves balancing the security of a government-backed investment against risks like inflation, interest rate changes, and opportunity costs, all within the context of the current economic climate.

Investing in bonds can be a great way to diversify your portfolio, but understanding the landscape is key. Let’s explore **What are the Potential Risks and Rewards of Investing in US Treasury Bonds with a Maturity of 10 Years in the Current Economic Climate?** to help you make informed financial decisions.

Anúncios

Understanding US Treasury Bonds

US Treasury bonds are debt securities issued by the US government to finance its spending. They are considered one of the safest investments due to the backing of the full faith and credit of the US government.

These bonds come in various maturities, ranging from a few months to 30 years. The 10-year Treasury bond is particularly significant as it often serves as a benchmark for other interest rates, including mortgages and corporate bonds.

Anúncios

What Are Treasury Bonds?

Treasury bonds are essentially loans you make to the government. In return, the government promises to pay you interest payments (coupon payments) regularly until the bond matures, at which point you receive the face value of the bond.

Why Invest in Treasury Bonds?

- Safety: Backed by the US government, making them a low-risk investment.

- Regular Income: Provide a steady stream of income through coupon payments.

- Diversification: Can help balance a portfolio by providing stability during economic downturns.

Understanding these basics sets the stage for evaluating the potential risks and rewards of investing in 10-year Treasury bonds.

Potential Rewards of Investing in 10-Year Treasury Bonds

Investing in 10-year US Treasury bonds can offer several attractive rewards. These benefits stem from their relative safety, predictable income streams, and potential for capital appreciation in certain economic conditions.

Let’s delve deeper into the specific advantages that make these bonds a compelling choice for many investors.

Steady Income Stream

One of the primary benefits of investing in 10-year Treasury bonds is the predictable income they provide. These bonds pay fixed interest rates (coupon payments) semi-annually, offering investors a steady stream of income over the life of the bond.

Capital Preservation

Treasury bonds are generally considered a safe haven asset. During times of economic uncertainty or market volatility, investors often flock to the safety of US Treasury bonds, which can lead to an increase in their price.

Portfolio Diversification

Treasury bonds can play a crucial role in diversifying an investment portfolio. Their low correlation with other asset classes, such as stocks, can help reduce overall portfolio risk.

- Lower Correlation: Bonds tend to move differently than stocks, reducing portfolio volatility.

- Balanced Returns: Provide stability and balance returns, especially during market downturns.

- Reduced Risk: Adding bonds to a portfolio can lower the overall risk profile.

These rewards collectively make 10-year Treasury bonds an attractive option for investors seeking stability, income, and diversification.

In summary, the potential rewards of investing in 10-year Treasury bonds include a reliable income stream, capital preservation during economic uncertainty, and enhanced portfolio diversification.

Potential Risks of Investing in 10-Year Treasury Bonds

While 10-year Treasury bonds offer relative safety, they are not without risks. Investors need to be aware of these potential downsides to make informed decisions.

These risks primarily stem from the bond’s sensitivity to interest rate changes and inflation.

Interest Rate Risk

Interest rate risk is the most significant risk associated with investing in bonds. When interest rates rise, the value of existing bonds typically falls, as newly issued bonds offer higher yields.

Inflation Risk

Inflation risk refers to the possibility that the purchasing power of the bond’s fixed interest payments and principal repayment will be eroded by inflation.

Opportunity Cost

Opportunity cost is the potential return an investor misses out on by choosing one investment over another. While Treasury bonds offer safety and stability, they may provide lower returns compared to riskier assets like stocks.

- Lower Growth Potential: Bonds generally offer lower returns than stocks over the long term.

- Missed Opportunities: Investing solely in bonds may limit exposure to higher-growth assets.

- Trade-offs: Investors must balance safety and potential returns.

Understanding these risks is crucial for anyone considering investing in 10-year Treasury bonds.

In conclusion, the potential risks of investing in 10-year Treasury bonds include interest rate risk, inflation risk, and opportunity cost.

The Current Economic Climate and Its Impact

The current economic climate significantly impacts the investment landscape for 10-year Treasury bonds. Factors such as inflation rates, Federal Reserve policy, and overall economic growth play a pivotal role in determining the attractiveness of these bonds.

Understanding these dynamics is essential for making informed investment decisions.

Inflation Rates

High inflation erodes the real return of Treasury bonds. If inflation is higher than the bond’s yield, the investor effectively loses purchasing power over time. Inflation expectations can drive bond yields higher as investors demand more compensation for inflation risk.

Federal Reserve Policy

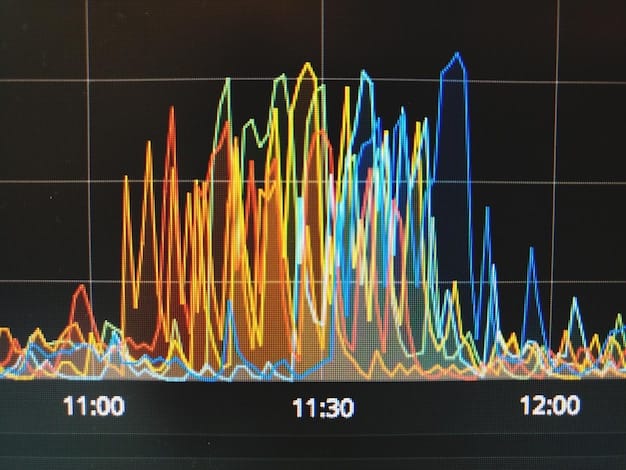

The Federal Reserve (the Fed) plays a crucial role in influencing interest rates. The Fed’s monetary policy decisions, such as raising or lowering the federal funds rate, directly impact Treasury bond yields.

Economic Growth

Strong economic growth often leads to higher interest rates, as demand for credit increases. Conversely, during economic slowdowns, interest rates may fall as the Fed attempts to stimulate growth.

Strategies for Managing Risks and Maximizing Rewards

Successfully investing in 10-year Treasury bonds involves employing strategies to manage risks and maximize potential rewards. These strategies can help investors navigate the complexities of the bond market and achieve their financial goals.

Here are some key approaches to consider:

Diversification

Diversifying across different asset classes, including stocks, bonds, and real estate, can help reduce overall portfolio risk. Within the bond portion of a portfolio, consider diversifying across different maturities and types of bonds.

Laddering

Bond laddering involves purchasing bonds with staggered maturities. This strategy helps to mitigate interest rate risk, as some bonds will mature and can be reinvested at current interest rates.

Active Management

Actively managing a bond portfolio involves making adjustments based on economic conditions and market outlook. This may include shortening or lengthening the portfolio’s duration, depending on interest rate expectations.

- Adjust Duration: Shorten duration when rates are expected to rise, lengthen when rates are expected to fall.

- Monitor Economic Indicators: Stay informed about inflation, economic growth, and Fed policy.

- Rebalance Regularly: Adjust portfolio holdings to maintain desired asset allocation.

By implementing these strategies, investors can better manage the risks and enhance the potential rewards of investing in 10-year Treasury bonds.

In brief, managing risks and maximizing rewards involve diversification, laddering, and active portfolio management.

Alternatives to 10-Year Treasury Bonds

While 10-year Treasury bonds offer a blend of safety and income, investors should also consider alternative investments that may provide potentially higher returns or different risk profiles.

Exploring these alternatives can help tailor an investment strategy to individual needs and goals.

Corporate Bonds

Corporate bonds are debt securities issued by companies. They generally offer higher yields than Treasury bonds, but also come with higher credit risk.

Municipal Bonds

Municipal bonds are issued by state and local governments. They offer tax-exempt interest income, which can be attractive to investors in high tax brackets.

High-Yield Bonds

High-yield bonds, also known as junk bonds, are issued by companies with lower credit ratings. They offer higher yields to compensate for the increased risk of default.

By considering these alternatives, investors can broaden their investment horizons and potentially achieve better risk-adjusted returns.

In summary, alternatives to 10-year Treasury bonds include corporate bonds, municipal bonds, and high-yield bonds.

| Key Point | Brief Description |

|---|---|

| 🛡️ Safety | Backed by the US government; considered a low-risk investment. |

| 💸 Income | Provides a steady stream of income through fixed coupon payments. |

| 📈 Inflation Risk | Erosion of purchasing power due to rising inflation rates. |

| ⏳ Opportunity Cost | Lower potential returns compared to riskier assets like stocks. |

Frequently Asked Questions

▼

Yes, Treasury bonds are subject to federal income tax, but they are exempt from state and local taxes. This can be a significant advantage for investors living in high-tax states.

▼

Treasury bonds can be purchased directly from the US Treasury through TreasuryDirect.gov, or through a broker. Buying directly can save on commission fees.

▼

The yield on a 10-year Treasury bond fluctuates daily based on market conditions. You can find the current yield on financial news websites or through your broker.

▼

Treasury bonds can be a valuable component of a retirement portfolio due to their stability and income-generating potential. However, diversification with other asset classes is crucial.

▼

When interest rates rise, the value of existing Treasury bonds typically declines. This is because newly issued bonds offer higher yields, making older bonds less attractive to investors.

Conclusion

Investing in 10-year US Treasury bonds requires careful consideration of the current economic climate and the potential risks and rewards involved. While they offer safety and a steady income stream, investors must be mindful of interest rate risk, inflation risk, and opportunity costs. By understanding these factors and employing appropriate investment strategies, individuals can make informed decisions that align with their financial goals.